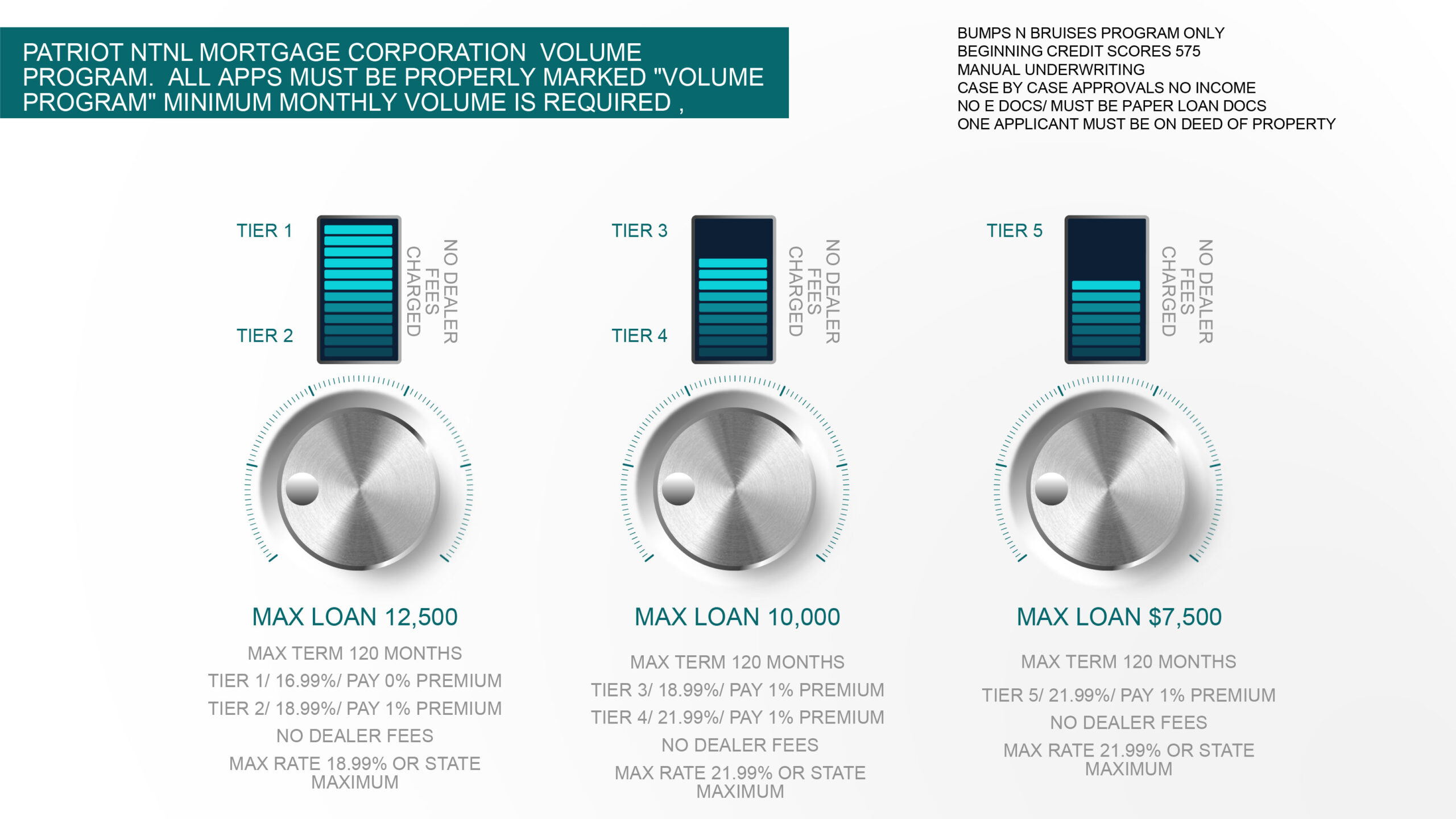

The Bumps n Bruises Program

This program is for people that had credit issues but now out of the issues but their scores have not caught up yet.

- Loan Amounts to $12,500

- Loan Terms to 120

- No Dealer Fees

- Electronic Docs are Not Permitted

- No Proof of Income

- Verification Call at Completion

- 90 Day Approvals

- POHO Stipulation Required

- No Mobile or Manufactures Homes

- All Stipulations must be Cleared to Receive Paper Docs